Featured

Table of Contents

A degree term life insurance policy can offer you comfort that the people who depend upon you will certainly have a survivor benefit throughout the years that you are planning to sustain them. It's a means to aid look after them in the future, today. A degree term life insurance (often called degree costs term life insurance policy) plan supplies insurance coverage for an established variety of years (e.g., 10 or twenty years) while maintaining the premium settlements the same throughout of the plan.

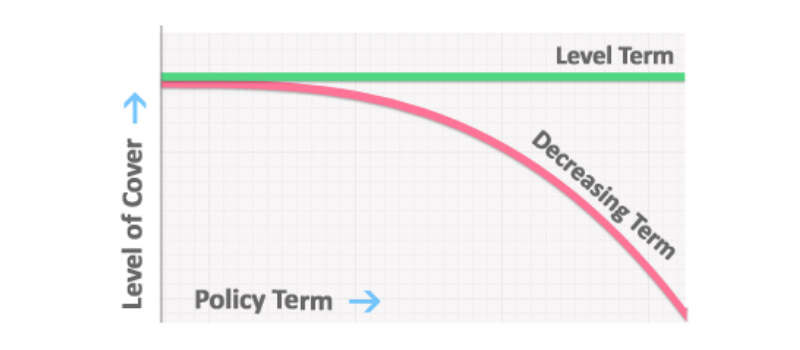

With level term insurance coverage, the price of the insurance coverage will certainly stay the same (or potentially reduce if rewards are paid) over the regard to your plan, normally 10 or 20 years. Unlike long-term life insurance, which never ever runs out as lengthy as you pay costs, a degree term life insurance policy plan will end eventually in the future, normally at the end of the period of your degree term.

What is Term Life Insurance With Accidental Death Benefit? Key Information for Policyholders

Since of this, lots of people utilize irreversible insurance policy as a secure financial planning tool that can offer numerous demands. You may have the ability to transform some, or all, of your term insurance policy during a set duration, commonly the initial one decade of your policy, without requiring to re-qualify for insurance coverage also if your wellness has changed.

As it does, you might want to add to your insurance protection in the future - Life Insurance. As this occurs, you might desire to at some point lower your fatality advantage or take into consideration converting your term insurance to an irreversible policy.

So long as you pay your premiums, you can relax easy recognizing that your loved ones will certainly receive a death benefit if you die during the term. Lots of term plans enable you the ability to transform to irreversible insurance without having to take one more wellness examination. This can enable you to make use of the fringe benefits of a long-term plan.

Level term life insurance coverage is just one of the most convenient courses right into life insurance policy, we'll review the benefits and downsides to make sure that you can choose a strategy to fit your needs. Level term life insurance policy is one of the most common and fundamental kind of term life. When you're searching for momentary life insurance strategies, level term life insurance policy is one path that you can go.

The application process for degree term life insurance policy is normally really uncomplicated. You'll fill in an application which contains basic personal details such as your name, age, etc along with a more comprehensive survey regarding your medical background. Depending upon the policy you have an interest in, you might need to take part in a medical checkup process.

The brief solution is no. A level term life insurance policy plan doesn't construct cash worth. If you're wanting to have a policy that you have the ability to take out or obtain from, you might explore irreversible life insurance. Entire life insurance coverage plans, for example, allow you have the convenience of death benefits and can accrue cash value in time, meaning you'll have a lot more control over your benefits while you live.

What Exactly Does Level Term Life Insurance Meaning Offer?

Motorcyclists are optional stipulations included to your plan that can provide you fringe benefits and securities. Cyclists are a fantastic way to include safeguards to your policy. Anything can occur over the training course of your life insurance coverage term, and you wish to await anything. By paying simply a little bit more a month, cyclists can provide the support you need in instance of an emergency.

This cyclist provides term life insurance policy on your youngsters through the ages of 18-25. There are instances where these advantages are built into your plan, but they can likewise be readily available as a different enhancement that needs additional repayment. This biker supplies an additional survivor benefit to your recipient needs to you die as the result of an accident.

Table of Contents

Latest Posts

Final Expense Life Insurance

No Life Insurance Burial

Senior Funeral Insurance

More

Latest Posts

Final Expense Life Insurance

No Life Insurance Burial

Senior Funeral Insurance