Featured

Table of Contents

Costs are typically less than entire life plans. With a level term policy, you can select your insurance coverage quantity and the policy length. You're not locked right into an agreement for the rest of your life. Throughout your plan, you never ever need to stress over the premium or death advantage amounts changing.

And you can't squander your plan during its term, so you won't obtain any type of monetary gain from your past coverage. Similar to various other types of life insurance, the cost of a degree term policy depends upon your age, protection requirements, employment, way of living and health. Normally, you'll find much more budget-friendly insurance coverage if you're more youthful, healthier and less dangerous to guarantee.

Considering that level term costs remain the same for the duration of coverage, you'll know specifically just how much you'll pay each time. Degree term insurance coverage likewise has some flexibility, allowing you to tailor your policy with extra features.

You might have to meet specific problems and certifications for your insurance firm to pass this cyclist. There also might be an age or time limitation on the protection.

Level Term Life Insurance For Families

The survivor benefit is normally smaller sized, and insurance coverage normally lasts till your child turns 18 or 25. This motorcyclist might be a much more cost-efficient method to help guarantee your youngsters are covered as bikers can typically cover multiple dependents simultaneously. When your youngster ages out of this insurance coverage, it might be feasible to convert the cyclist right into a brand-new policy.

The most usual type of permanent life insurance is entire life insurance coverage, yet it has some key distinctions compared to level term protection. Right here's a fundamental overview of what to think about when contrasting term vs.

Whole life insurance lasts insurance policy life, while term coverage lasts insurance coverage a specific periodCertain The premiums for term life insurance are commonly lower than entire life insurance coverage.

What happens if I don’t have Level Term Life Insurance Rates?

One of the primary features of degree term insurance coverage is that your premiums and your death benefit do not change. You might have insurance coverage that begins with a death benefit of $10,000, which might cover a mortgage, and then each year, the fatality benefit will certainly reduce by a set quantity or percent.

Due to this, it's often an extra inexpensive kind of degree term protection., but it may not be enough life insurance for your demands.

After determining on a plan, complete the application. If you're accepted, authorize the documents and pay your very first premium.

Finally, take into consideration scheduling time yearly to review your plan. You may intend to update your beneficiary info if you've had any type of substantial life modifications, such as a marital relationship, birth or separation. Life insurance policy can sometimes really feel challenging. But you don't have to go it alone. As you discover your alternatives, consider discussing your needs, wants and worries about an economic professional.

What is the process for getting Level Term Life Insurance Rates?

No, degree term life insurance policy does not have cash worth. Some life insurance policy plans have a financial investment feature that enables you to construct money worth gradually. What is level term life insurance?. A section of your costs repayments is alloted and can earn interest over time, which expands tax-deferred throughout the life of your protection

However, these plans are commonly considerably much more pricey than term insurance coverage. If you reach the end of your policy and are still alive, the insurance coverage finishes. Nevertheless, you have some alternatives if you still want some life insurance policy coverage. You can: If you're 65 and your coverage has actually run out, for instance, you may wish to purchase a brand-new 10-year level term life insurance policy.

Level Term Life Insurance Benefits

You might have the ability to convert your term protection right into an entire life plan that will certainly last for the remainder of your life. Many types of level term policies are exchangeable. That indicates, at the end of your protection, you can transform some or all of your policy to whole life protection.

Level term life insurance policy is a policy that lasts a collection term typically between 10 and three decades and includes a level death advantage and degree costs that remain the same for the whole time the policy holds. This means you'll recognize specifically just how much your payments are and when you'll need to make them, enabling you to budget plan as necessary.

Degree term can be an excellent alternative if you're wanting to buy life insurance policy protection for the initial time. According to LIMRA's 2023 Insurance Measure Study, 30% of all adults in the U.S. need life insurance policy and do not have any type of policy yet. Level term life is predictable and inexpensive, that makes it among the most preferred kinds of life insurance

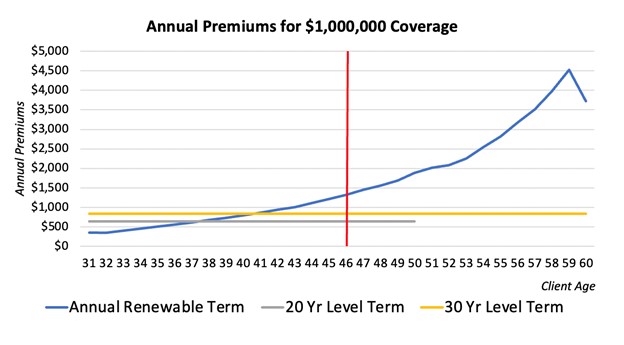

A 30-year-old male with a similar account can anticipate to pay $29 monthly for the exact same coverage. AgeGender$250,000 protection amount$500,000 coverage amount$1 million insurance coverage amount20Female$15$23$34Male$19$29$4830Female$15$23$37Male$18$29$4940Female$22$35$61Male$25$43$7550Female$44$78$139Male$57$102$18860Female$108$194$355Male$149$268$500 Collapse table Methodology: Typical monthly rates are calculated for male and women non-smokers in a Preferred health and wellness category acquiring a 20-year $250,000, $500,000, or $1,000,000 term life insurance coverage policy.

How do I cancel Level Premium Term Life Insurance?

Rates might vary by insurer, term, protection quantity, health and wellness course, and state. Not all plans are available in all states. Rate picture legitimate as of 09/01/2024. It's the most inexpensive form of life insurance for most individuals. Degree term life is far more budget-friendly than a comparable whole life insurance policy policy. It's simple to take care of.

It allows you to budget and prepare for the future. You can quickly factor your life insurance coverage right into your budget because the premiums never ever alter. You can prepare for the future equally as quickly due to the fact that you understand exactly how much cash your enjoyed ones will get in case of your absence.

What happens if I don’t have Low Cost Level Term Life Insurance?

This holds true for individuals that gave up cigarette smoking or who have a wellness problem that fixes. In these situations, you'll normally have to go with a brand-new application procedure to obtain a far better rate. If you still require coverage by the time your level term life plan nears the expiration day, you have a few options.

Table of Contents

Latest Posts

Final Expense Life Insurance

No Life Insurance Burial

Senior Funeral Insurance

More

Latest Posts

Final Expense Life Insurance

No Life Insurance Burial

Senior Funeral Insurance